Legal Recruitment - What we can learn from the 2008 crisis

This blog is part of a series exploring strategies through economic turmoil.

In the introduction to this series, Pirical CEO and Founder Jason Ku introduced three things that resilient companies focus on to weather a downturn:

- Relentless focus on customers

- Strategically manage costs and invest for the future

- Get ready to ride the wave of recovery

This article looks at the second theme - strategically manage costs and invest for the future. More specifically, how law firms can manage their hiring amidst all the uncertainty.

It’s a conundrum: Freezing hiring and trainee intake and reducing retention of qualified trainees can help with cashflow to ensure firm survival in a crisis. However, if the crisis is short-lived, these measures can have huge opportunity costs, and result in a talent shortage several years later when things have picked up again.

Thankfully, as Ray Dalio says in “Principles” about economic downturns: “It has all happened before.”

Most recently, in 2008. And we can learn from that crisis.

What did firms do in 2008?

In 2017, we ran an analysis looking at the aftermath of the 2008 financial crisis on the legal recruitment market. One of our findings was:

In 2008, many UK law firms reacted by reducing their trainee cohorts.

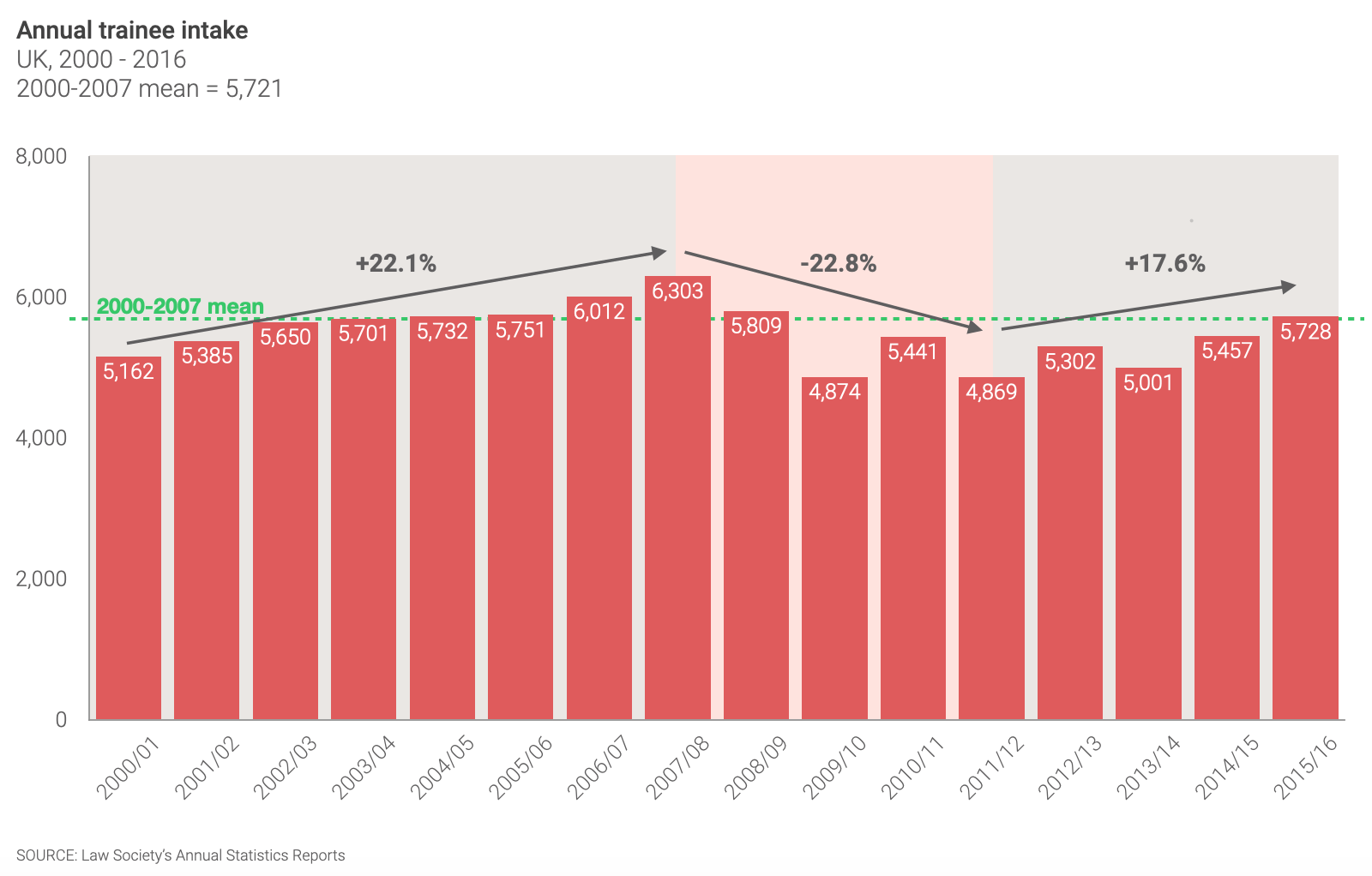

In the UK, the annual intake of trainee solicitors fell by 22.8% in the 4 years following Lehman Brothers’ collapse.

One of the particularities of the UK’s lawyer training programme, or “Training Contract”, is that recruitment occurs two or three years in advance. And so, while the positive financial impact of deferring or retracting Training Contracts in 2008-10 was immediate, the decision to resume hiring in 2011-13 only showed effect in 2014-16.

During the 2008 crisis, UK law firms also retained fewer newly qualified lawyers

In the top 90 UK law firms, retention rates of newly qualified lawyers fell by 8.8% over the next couple of years.

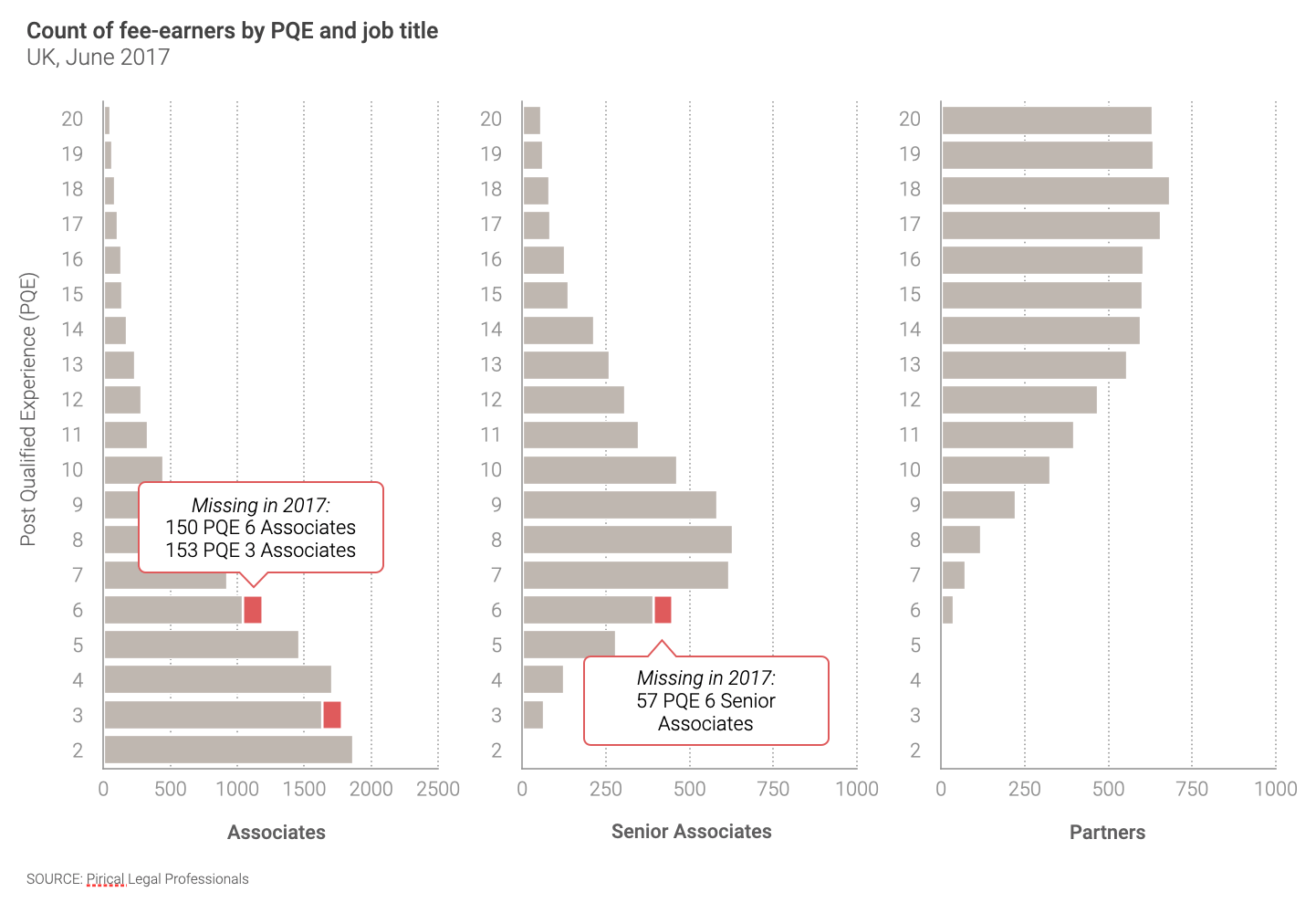

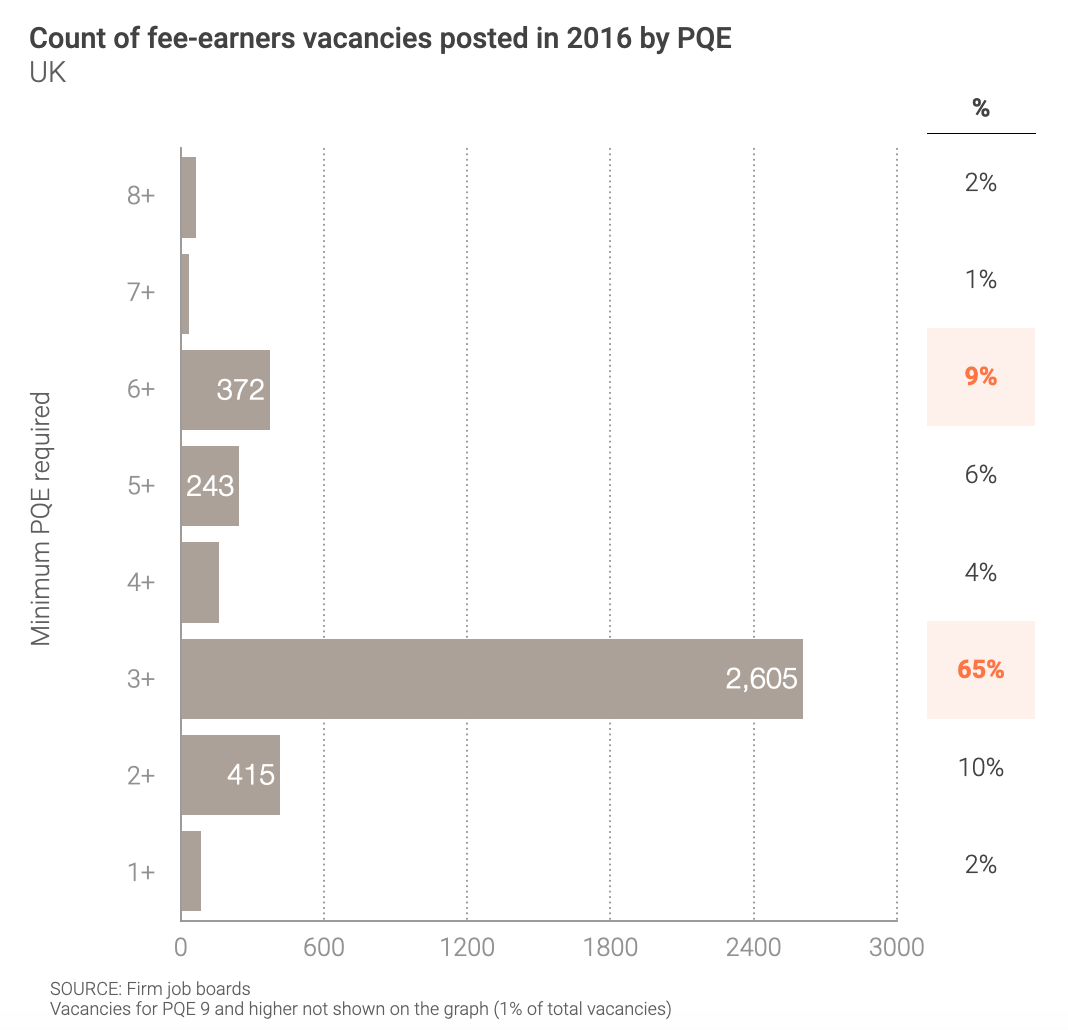

As a result, in 2017, we saw two gaps in the market:

- A gap in lawyers with 3 years of experience (PQE 3), who had not been hired as trainees in 2008 and onward.

- A gap in lawyers with 6 years of experience (PQE 6), who had been trainees in 2008-10 but had not been retained.

These two gaps are disproportionately painful because they are in that sweet spot of having considerable experience, without being very expensive yet.

It created a war for talent later on, where nearly all recruitment teams were hunting for a diminished pool of PQE 3 and 6 lawyers.

With an average hourly rate of £250 for PQE 3 and £320 for PQE 6 and a target of 1500 chargeable hours a year, this shortage of talent represents an overall lost lost business opportunity of £157m per year.

Once eliminated, these hours are not easy to recover because these roles were never created: students who had not been offered a Training Contract, and newly qualified lawyers who had not been retained might have gone to a different industry altogether.

What will happen today if the industry reacts the same way

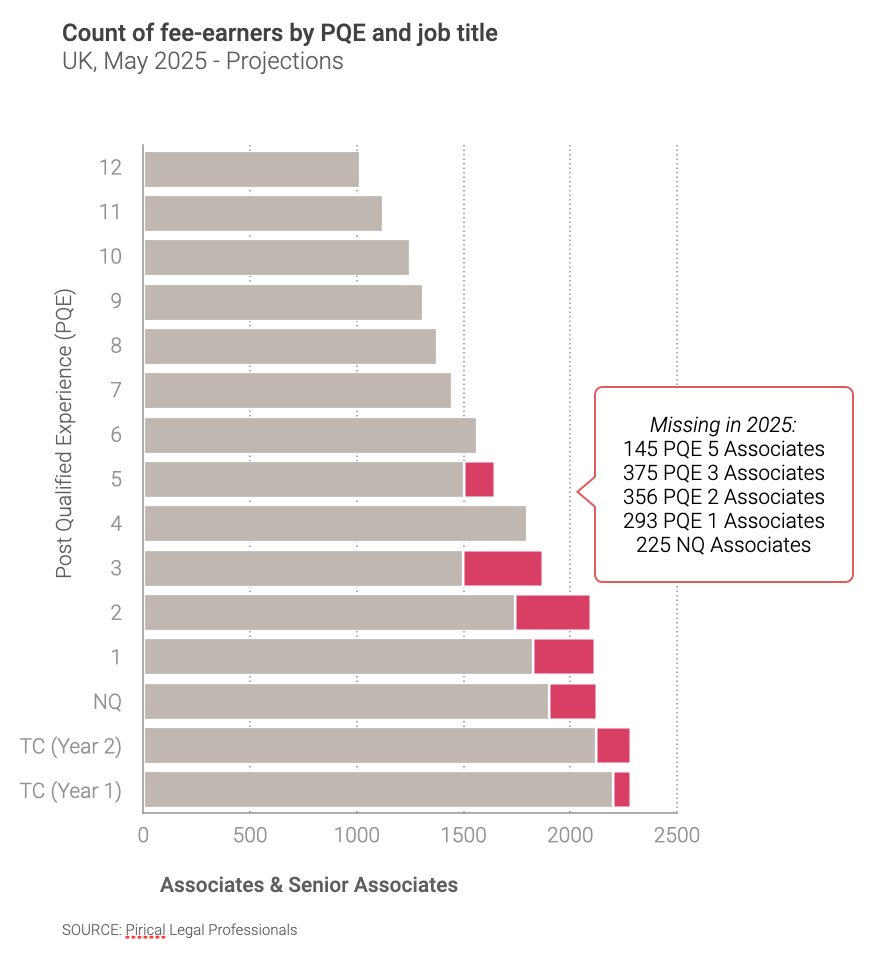

If the industry today reacts the way it did in 2008, the top 100 UK law firms (2,200 Training Contracts) will each save £1.4m over 3 years. But there will be a shortage of

- 225 NQs,

- 293 PQE 1,

- 356 PQE 2,

- 375 PQE 3, and

- 145 PQE 6

across the top 100 UK law firms by 2025. This represents a total opportunity cost of £500m.

Is there an alternative way of handling the 2020 crisis? While only time will tell if today’s actions prove correct, here’s a way to think about it.

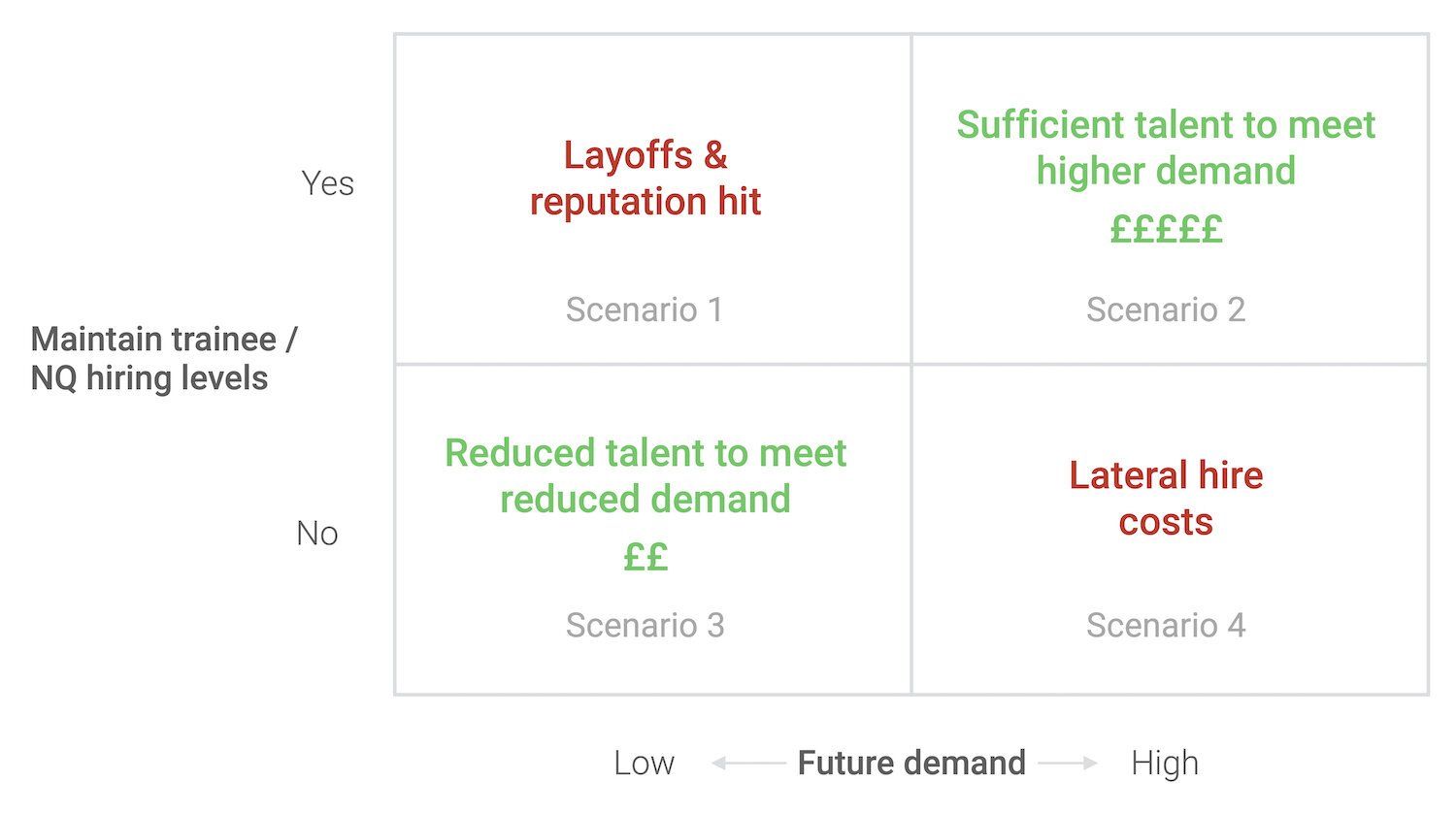

What are the scenarios, depending on the future economic outlook?

There are 4 ways things might play out:

- Scenario 1: Firms maintain their trainee intake and NQ retention because the crisis is expected to be short or mild, but future demand turns out to be low (i.e. the crisis is deep or long). —> Firms will have to lay off staff, which is never a pleasant thing to have to do.

- Scenario 2: Firms maintain their trainee hiring, and future demand indeed is high. —> Firms will be in a good position to satisfy the demand, and revenues will soar.

- Scenario 3: Firms reduce their trainee intake and NQ retention because they expect future demand to be low. And this then plays out - future demand is indeed low. —> Firms will have the necessary headcount to satisfy the demand, and revenues will be low due to reduced demand. No or only a few layoffs will be needed.

- Scenario 4: Firms reduce trainee hiring, but future demand turns out to be high. —> Firms won’t be in a good position to satisfy the demand, which might result in lost opportunities. Firms will scramble to recruit to try to meet demand, incurring high recruitment fees chasing after a significantly reduced talent pool.

In 2008, some firms may have acted to avoid scenario 1. Looking back, it seems that future demand from 2008 was high: the top 100 UK firms revenues increased by 28.7% from 2008 to 2013. Was it the right call to reduce trainee and NQ hiring?

Conclusion

Before committing to a route in 2020, it’s worth going back in time to reflect:

Which path did your firm choose back in 2008, in expectation of what kind of future? Which of the four scenarios listed above came to be in the end? How did that play out in the end and how did it affect your firm?

And most importantly - what kind of lesson can you draw from the experience a dozen years ago?

By signing up to our mailing list, you can get email notifications when we publish.

Subscribe to the latest data insights & blog updates

Fresh, original content for Law Firms and Legal Recruiters interested in data, diversity & inclusion, legal market insights, recruitment, and legal practice management.