What are the UK’s biggest consumers of legal services looking for?

This blog is part of a series exploring strategies through economic turmoil.

In the introduction to this series, Pirical CEO and Founder Jason Ku introduced three things that resilient companies focus on to weather a downturn:

- Relentless focus on customers

- Strategically manage costs and invest for the future

- Get ready to ride the wave of recovery

This article looks at the first theme - relentless focus on customers.

To help law firms to understand their biggest customers better at this difficult time, we ar e pleased to share for the first time insights from recent Pirical research.

We interviewed General Counsels from a cross-section of FTSE 350 companies

In the last year, Pirical has interviewed 18 General Counsels (GCs) from FTSE 350 companies to understand their priorities for the future of the legal profession.

The companies we spoke to included Network Rail, Capita, Royal Mail, and Lloyds Banking Group.

We estimate that between them, these GCs control about 5 to 10 percent of all expenditure by UK publicly-listed companies on legal services.

The interviews were commissioned by the O-Shaped Lawyer project, which is setting out to transform the training & development of UK Lawyers, including evolving the current, but outdated, training contract model. In doing so the long-term ambition is to make the legal profession better for those who currently work in it, better for those who buy services from it and better for the next generation of lawyers entering it.

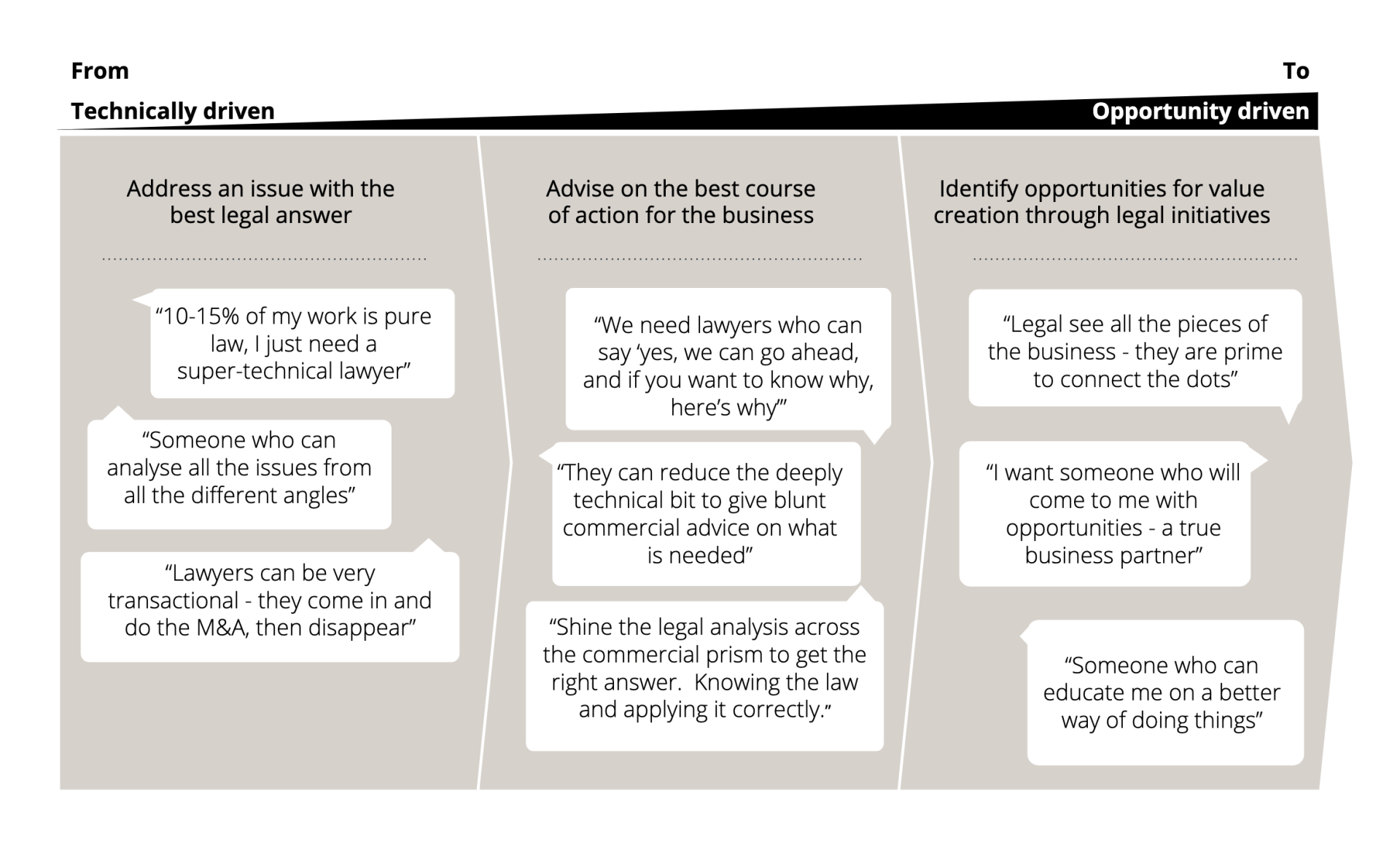

We found that GCs are asking for three types of legal services, with a shift towards value creation opportunities.

GCs told us:

- Today, law firms pick up most of their work by offering technically driven services: finding the best legal answer to an issue, as well as advising on the best course of action from a legal perspective

- In terms of GCs’ present demand for legal services, finding the best legal answer to a question is actually a relatively small amount of the work they have available - possibly only as much as 10 or 15 percent.

- Furthermore, the proportion of work that requires finding the best legal answer to a question is unlikely to increase in the future.

GCs have a clear direction of travel in mind:

- In future the most successful law firms will capitalise on an underserved area of activity, for which GCs say they have a large and growing appetite. This is around proactive value creation through legal initiatives.

- GCs are ready to spend big with firms who understand their business and can come to them with new ideas for how to create value, through legal initiatives.

Introducing the value-creation lawyer

With the help of GCs and Addleshaw Goddard, Pirical has identified a range of attributes that define value-creation lawyers, in terms of their mindsets, knowledge, and skills.

Our research suggests delivering value-creation legal services requires a blend of:

- Mindsets. Attitudes and beliefs on what it is to be a value-creation lawyer,

- Knowledge. Domains of understanding required to be a value-creation lawyer, and

- Skills. Abilities a value-creation lawyer is capable of.

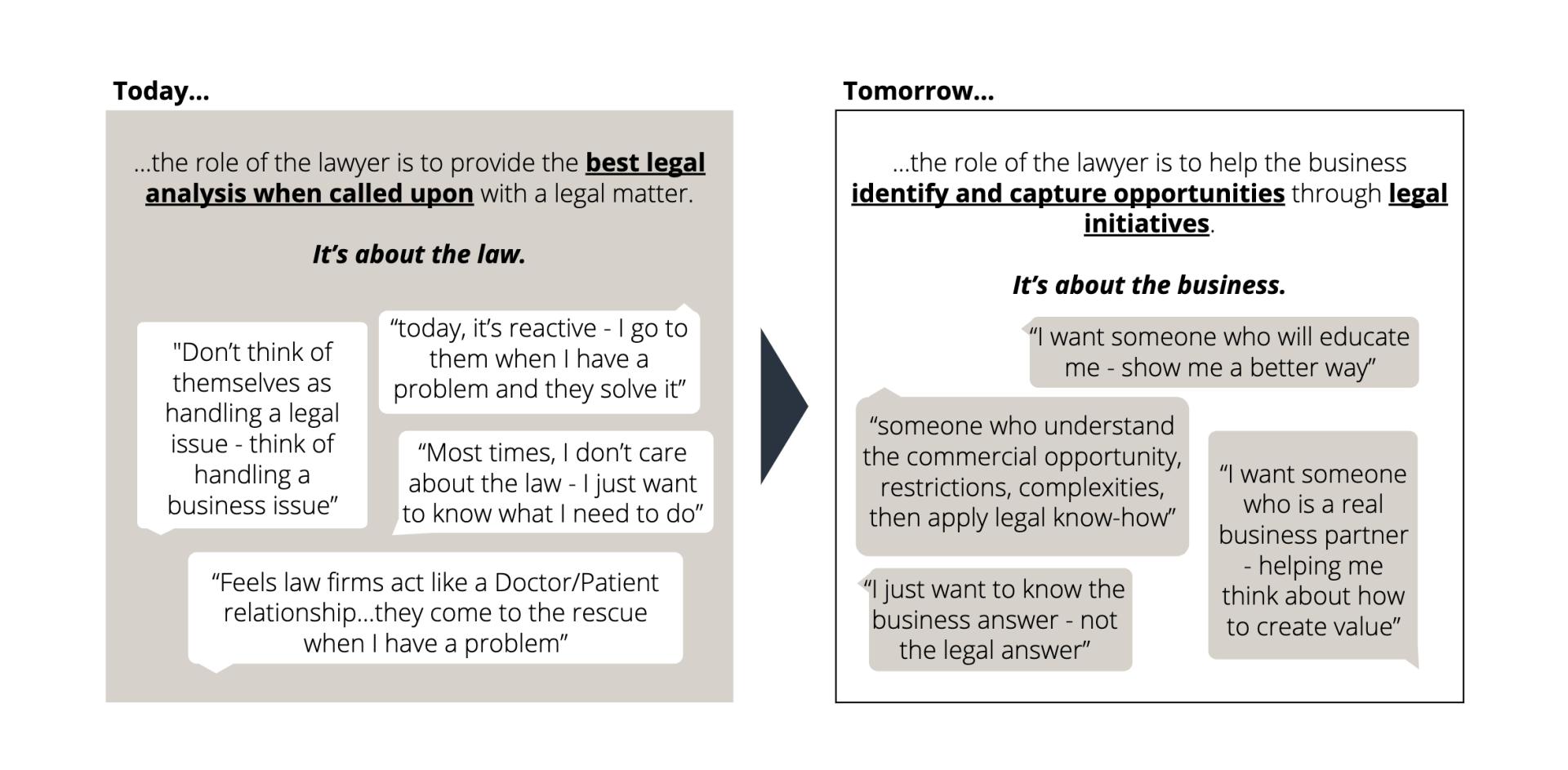

When it comes to Mindsets

, the next generation of lawyers will redefine what it means to be a lawyer.

GCs will expect their lawyers to behave and communicate more like commercial consultants or business partners, rather than pure legal experts:

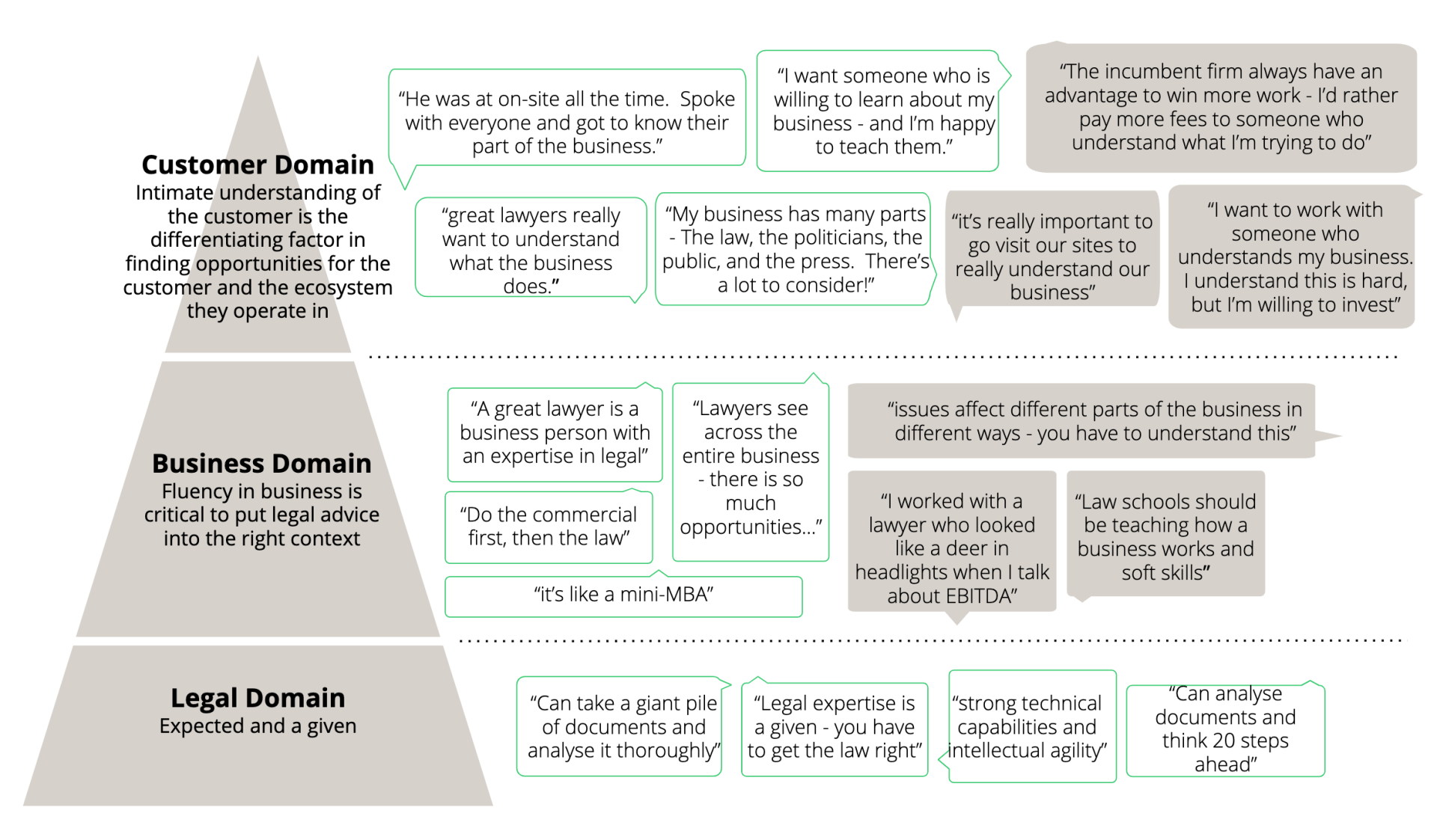

The next generation of lawyers will require broader knowledge of the business world and deeper understanding of their clients’ specific business:

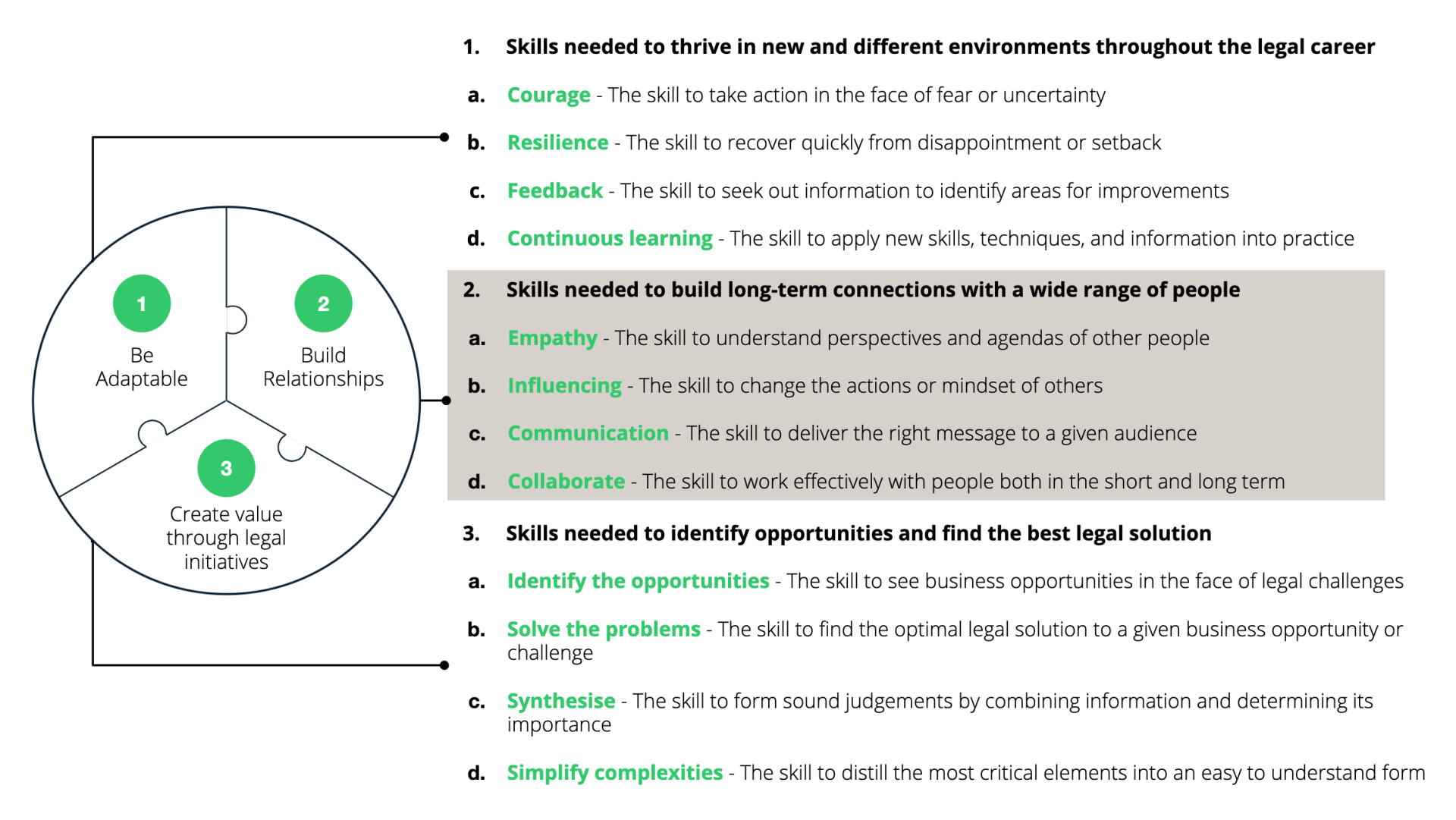

In terms of skills required to be a value creation lawyer, we have identified three groups of skills arising from the research:

- Adaptability skills

- Relationship-building skills

- Value creation skills

GCs see a gap between supply and demand

Our research, including defining the value-creation lawyer, does not highlight a completely new challenge for law firms.

Legal training such as the UK Legal Practice Course (LPC) and Graduate Diploma in Law (GDL) is already at pains to develop lawyers’ commerciality, as are many firms’ own professional development programmes.

However, the findings of the research, coupled with the fact it was commissioned in part by a group of GCs, show there’s still a gap between customer demand and market supply.

The O-Shaped Lawyer Project is an attempt to move the sector forward

The O-Shaped Lawyer project was set up with a mission to improve the legal ecosystem through a number of activities including:

- Listening and sharing - listening to what people want and sharing that across the ecosystem. For example, by commissioning research.

- Engaging - with universities, law schools and legal professionals to encourage and support them to innovate. For example, by engaging with consultations on course curriculums and training opportunities.

- Collaborating - working together as one legal ecosystem to make it better for everyone. For example, by designing and leading experiments.

- Connecting - bringing the profession, customers and education system closer together. For example, by hosting networking and events.

The research outlined above has so far been eagerly received by GCs and law firms alike. Already both Centrica and EasyJet have included adherence to the principles of the value creation lawyer in their most recent Request for Proposals, and firms including Addleshaw Goddard have made public their intention to get involved, kicking off pilot project only last week.

How can we help law firms focus on customer needs?

If you ask law firms today, many feel they already meet their clients’ expectations well, while balancing their own commercial pressures. For example, one practice-based lawyer said to us: “a lot of in-house lawyers forget we won’t just say ‘Yes’ to every question. For a start, in-house lawyers don’t have the same insurance restrictions as us. We have heavy-duty policies that reflect the nature of our work and our coverage is contingent on us giving accurate and responsible advice.”

Moving the sector forwards will not be trivial. It will require higher levels of understanding. It will require investment and compromise by all parties.

At a practical level, we believe it will require frequent, honest conversations - both at the team and individual level - as well as continuous experimentation between law firms and customers.

To this end, this year the O-Shaped Lawyer project is launching a series of pilots using the Pirical Team Barometer . The pilot tests how team development initiatives (branded ‘O-nitiatives’) focused around the 12 skills can strengthen the relationships between law firms and their customers, and improve outcomes for everyone.

Want to take part? Dan Kayne, General Counsel (Regions) Network Rail, will be running this pilot. You can contact him through info@oshapedlawyer.com to learn more.

Subscribe to the latest data insights & blog updates

Fresh, original content for Law Firms and Legal Recruiters interested in data, diversity & inclusion, legal market insights, recruitment, and legal practice management.