What's hot and what's not? Practice growth in the AM Law 100

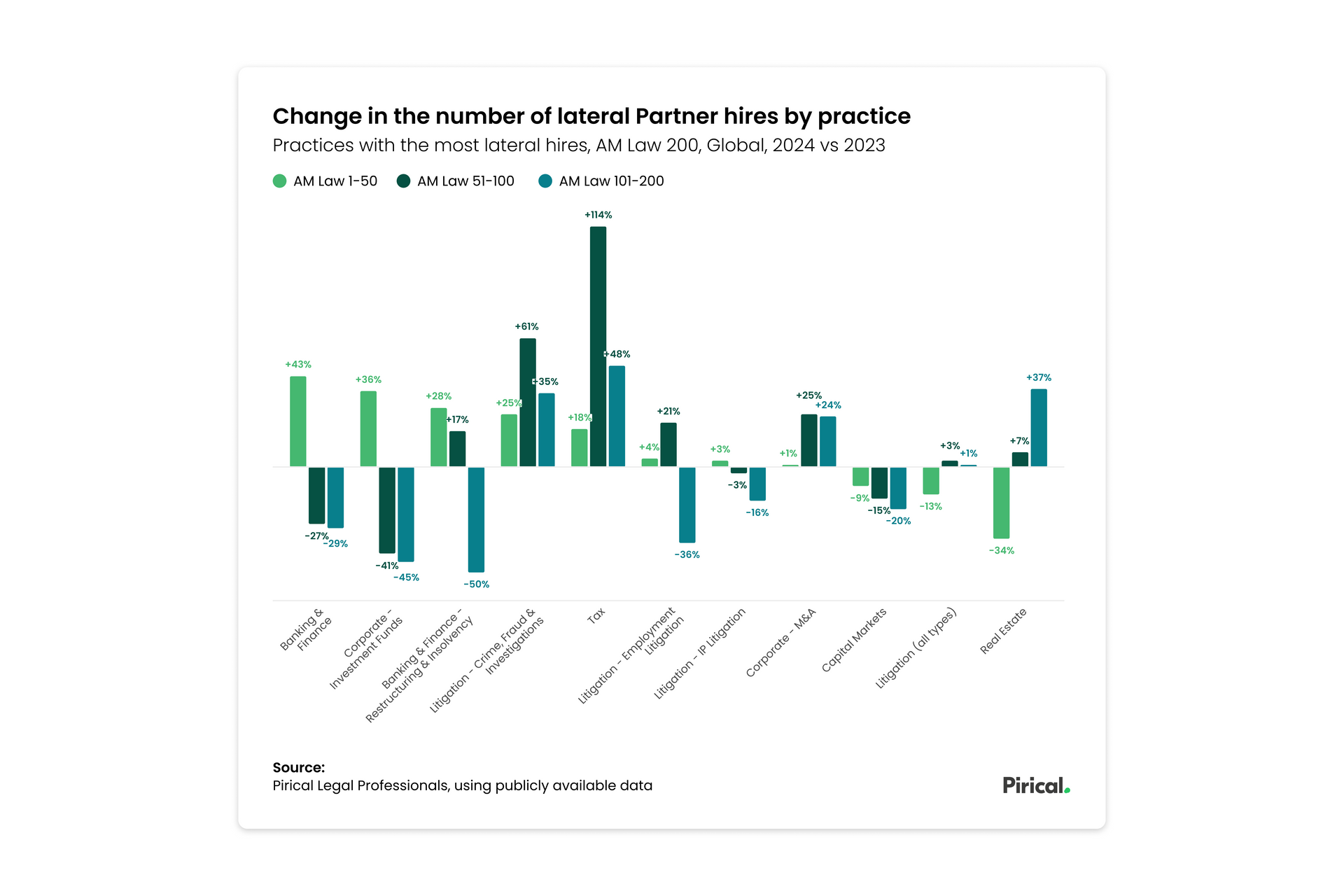

In Thomson Reuter's State of the US Legal Market 2024, a key finding was the ongoing shift from the "Transactional decade" (a period of strength for transactional practices such as Corporate, M&A, Real Estate, Tax) "to the more recent period in which the majority of growth in demand for law firm services has relied on counter-cyclical practices" (eg. Litigation, Labor & Employment, Bankruptcy).

This made us curious to dig a bit deeper into practice area growth among the AM Law 100 over the past few years. Using data from Pirical Legal Professionals (PLP), we've taken a look at Partner headcount growth by practice between 2019-2024 to reveal which practices are on the up and which have been shrinking!

Practices that have been growing 📈

What's hot? Top 30 growing practices in the AM Law 100

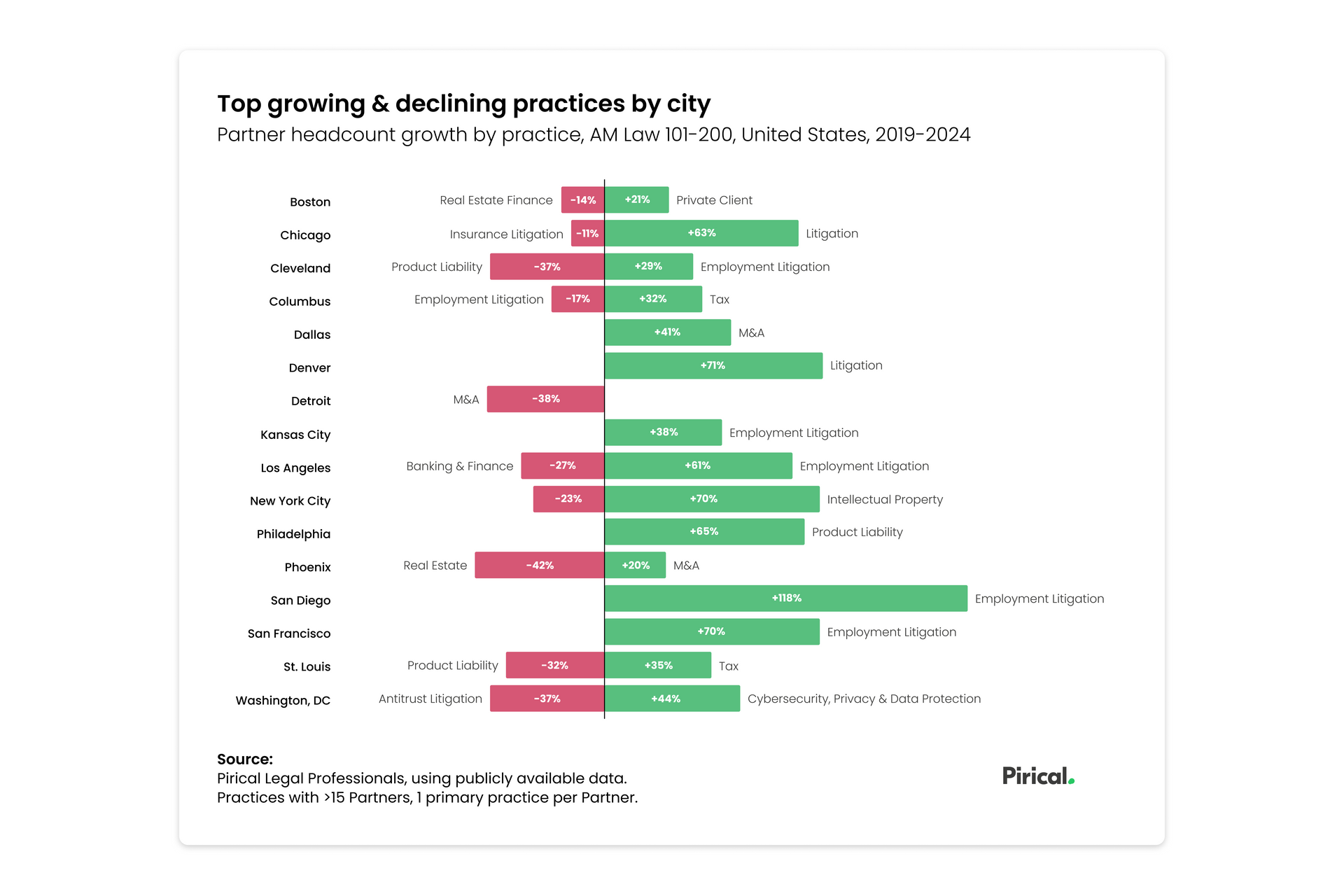

Cybersecurity, Privacy & Data Protection has boomed in New York City and Chicago

According to leaders of Sidley Austin's Privacy and Cybersecurity practice, views around privacy and data security are changing: "Concerns about misinformation and the misuse of personal information have created a 'crisis of new technologies' or 'techlash', which has shifted popular views about privacy in the United States and forced the hand of legislators and regulators."

It is interesting therefore, that the practice has also grown in Washington, DC (+14%).

Source: Lexology

Corporate has had the highest net growth in Partner headcount

Investment Funds has grown significantly across the East Coast of the US, Washington, DC (+44%), Chicago (+42%), Boston (+42%) and New York City (+36%).

M&A has grown

by an average of +26% in almost all the cities in our analysis, with Minneapolis (+60%), Philadelphia (+48%), Dallas (+34%) and Denver (+32%) all ranking in the top 30. Only San Diego (-11%) and St. Louis (-6%) saw a decline in M&A Partner headcount.

Dallas has been a focus of growth for AM Law 100 firms

Partner headcount in Dallas increased by +31% between 2019-2024, with M&A, Tax, Banking & Finance, Employment Litigation and Real Estate being the key practice areas driving this growth.

Many AM Law 100 firms have opened offices in Texas in recent years, drawn by the state's growing rank of corporations, "strong economy and healthy legal market".

Source: Major, Lindsey & Africa

Practices that have been shrinking 📉

What's not? Top 30 declining practices in the AM Law 100

San Francisco - Insurance Litigation is the practice with the sharpest decline

A number of AM Law 100 firms, including Cozen O'Connor, Gordon & Rees & Duane Morris have decreased their number of Partners working in Insurance Litigation in San Francisco. The practice has declined significantly from 2022 onwards.

Litigation practices make up much of the bottom 30

Although Litigation grew overall, by an average of +15% across the AM Law 100, various Litigation practices make up nearly half of the practice areas that have seen negative growth.

Changes in demand appear to vary by location and focus, eg. IP Litigation decreasing in Seattle (-16%), Palo Alto (-10%), Philadelphia (-9%) & Houston (-6%) and Antitrust Litigation shrinking in Chicago (-16%), New York City (-6%) & San Francisco (-5%).

California had relatively low growth over this period, partly driven by a decline in some Litigation practices

Silicon Valley has experienced a bit of an economic slump in recent years, with mass layoffs occurring in the tech sector. This trend may have influenced the decline of certain Litigation practices in the state. Some of California's top declining practices are Insurance Litigation (-29%) & Antitrust Litigation (-5%) in San Francisco, IP Litigation (-10%) in Palo Alto and Employment Litigation (-9%) in Los Angeles.

Although, bucking this West Coast trend with significant growth is Patents Litigation in San Francisco (+33%) and Employment Litigation in San Diego (+33%).

Note on methodology

Source: Pirical Legal Professionals, using publicly available data

Timeframe: 2019 - 2024

Only includes practices with more than 30 Partners and attributes 1 primary practice per Partner. Partners with multiple locations have been equally distributed across each.

Written using data from Pirical Legal Professionals (PLP)

Unlock unparalleled coverage of the legal market

Global attorney database built with the most comprehensive sources of data on the market. Designed for law firm lateral hiring teams, legal headhunters and strategy planners, our data tracks over 600,000 profiles across 130+ countries. PLP enables firms to source talent quicker, leverage their own network for referral opportunities, map out competitors’ org structures, research new markets and much more.

Subscribe to the latest data insights & blog updates

Fresh, original content for Law Firms and Legal Recruiters interested in data, diversity & inclusion, legal market insights, recruitment, and legal practice management.