Stroock from all sides: which rival firms have benefited from the demise of the 150-year old firm

At the end of October Stroock & Stroock & Lavan announced that the firm was dissolving after nearly 150 years of history.

The struggling New York firm had recently tried to save itself through merger talks with Nixon Peabody and Pillsbury Winthrop Shaw & Pittman. The failures of these talks coupled with a string of high profile departures has resulted in a rapid recent decline to Stroock's Partnership.

All of Stroock's offices have suffered from Partner departures

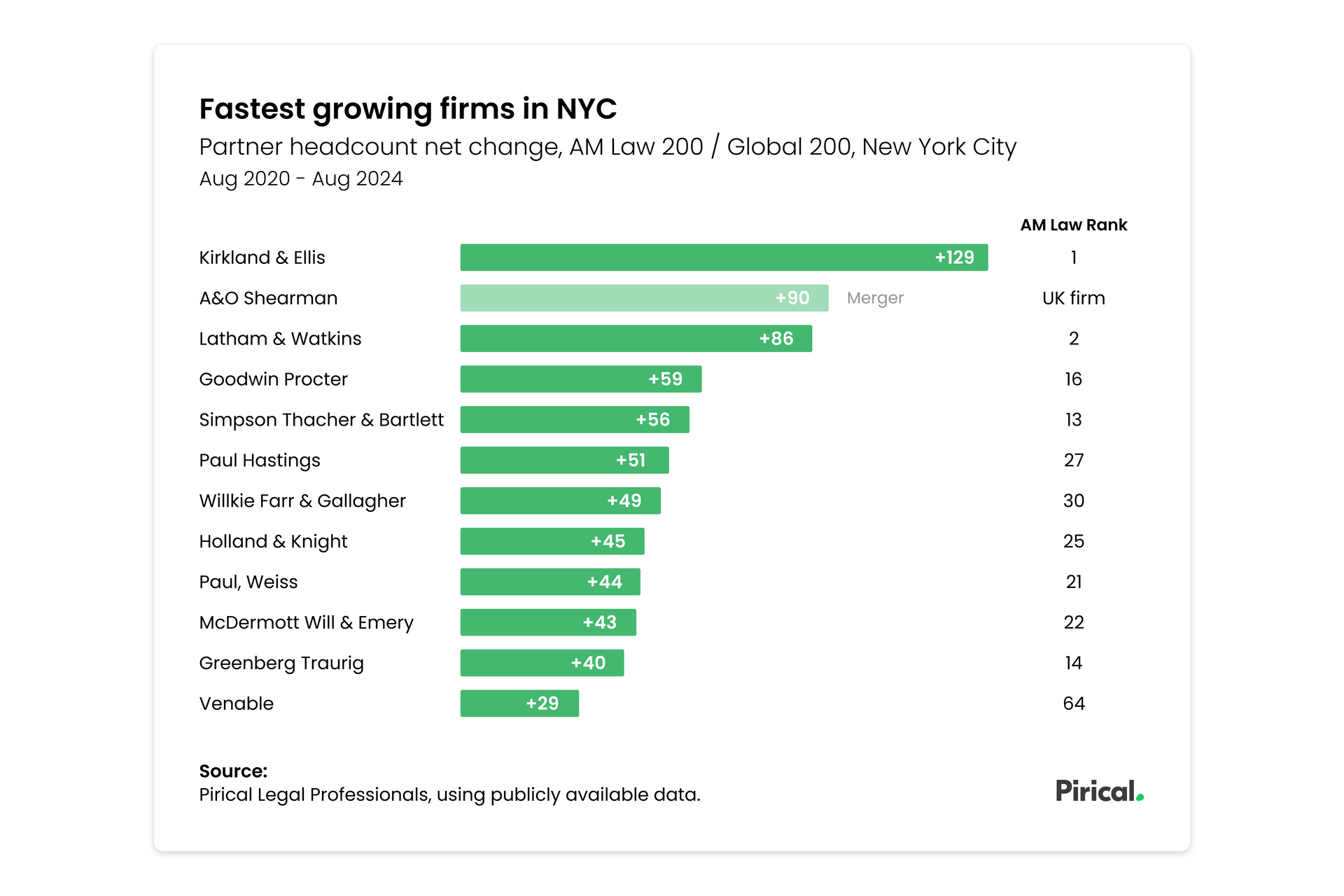

54 Partners have left the firm in 2023, marking a 76% decline in headcount. All four of the firm's offices have felt the impact as rival firms across the US have capitalised on Stroock's difficulties.

Rival law firms have been poaching large groups of Stroock Partners

Quite a few rival firms have benefited from Stroock's struggles in recent years. The first major loss of a large group of Partners came in March 2022 when Paul Hastings hired an 18-Partner Restructuring team based in New York.

In 2023 the scale of the departures increased. Shortly after Stroock's merger talks with Nixon Peabody failed, both Steptoe & Johnson (5) and Morgan Lewis (8) hired a significant number of Partners from a variety of offices and practice areas. While a number of other rivals picked off smaller numbers of Partners here and there.

Hogan Lovells just hired a huge group of Stroock Partners

At the end of October, amid the failed merger discussions with Pillsbury and increasing uncertainty about the future of the firm, Hogan Lovells announced it was snapping up 28 of Stroock's Partners. The vast majority of these hires are attorneys based in New York, with Real Estate being the key practice area.

The mass departures to Paul Hastings and Hogan Lovells gutted the leadership of two of Stroock's key practices, Restructuring and Real Estate. That impact plus the continued wave of smaller scale departures, has left Stroock with only a handful of Partners who will now likely join their former colleagues and move onto other firms.

Interested in legal market insights?

Understand the market better and gain insights on your competitors with Pirical Legal Professionals (PLP).

Our comprehensive market coverage and historic data allows you to monitor which law firms are thriving & which are churning, track attorney movements, and identify trends within the legal industry.

Subscribe to the latest data insights & blog updates

Fresh, original content for Law Firms and Legal Recruiters interested in data, diversity & inclusion, legal market insights, recruitment, and legal practice management.